About the company

Hyde Park Investment Services, Inc. (HPIS) provides advisory, analytical, and executive services to investment decision-makers. Our company was founded in 2015 in Chicago and named after the Hyde Park neighborhood, the home of the University of Chicago. Today we are an international team with a track record in private and public equity, corporate development, real estate, and other investment transactions.

Our clients include executives and directors of private and public companies, investment firms, and family offices. We are very proud to have retained our clients over the years while working on some of the largest and most complex transactions in the market. We believe that clear and quality analytics and professional execution are keys to well-run, successful transactions.

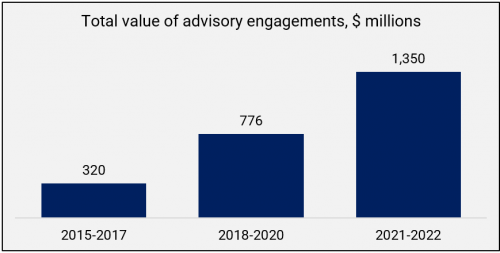

Our team offers a wide perspective on investment transactions and markets. We possess financial, operational, and strategic know-how from running business and overseeing investments. We offer subject matter expertise in financial and business analytics, market analytics, transaction structuring, and execution experience. Finally, we bring business development, project management, negotiation, and other communication capabilities and senses to the execution of investments. We count engagements in well over fifty industries in North America, Europe, and Asia and over $16 billion in closed transactions.

Over the years we have made several expansions of our enterprise. Our branches outside of advisory include private equity holdings, public equity holdings, and physical commodities. The goal of these branches of our enterprise is to operate and invest in ventures, where we have a competitive advantage, often together with incumbent leaders.

Our advisory business

Private Equity

We offer buy-side advisory and executive services for private equity and real estate investors. Services comprise all phases of principal equity activity. Market strategy, deal origination campaigns, and deal sourcing. Comprehensive investment analytics including financial, business, market, risk, and other considerations. Comprehensive due diligence including financial, operational, regulatory, and other areas. Closing management, post-closing implementations, and other deal management services. Our track record includes work with private equity and venture capital firms, independent sponsors, search funds, and other investment vehicles.

Corporate Advisory

Advisory services and staffing for corporate finance, corporate development, and other corporate leadership functions. The track record of our team includes mergers of global public companies, initial public offerings, and nationwide real estate portfolios. We have advised executives and boards of directors on strategy, financings, public and private share offerings, share and asset purchases and sales, mergers and acquisitions, restructurings, joint ventures, post-merger integrations, corporate integrations and transformations, and other scenarios.

Analytics and Research

Expert on-demand financial analysis, financial modeling, financial planning, corporate budgeting, business analytics, fundamental research, equity research, market research, economic research, data modeling, data visualization, machine learning, algorithmic trading, portfolio analysis, investment strategy design, and other advanced financial analysis, data science, and quant research services.

HPIS Ventures: Our portfolio companies

Since 2016. The mission of Evolution Careers is preparing the next generation of professionals for the most competitive jobs. The company does that by creating, curating, and administering professional training programs, including internships, externships, mentorships, and topical seminars. Our learning scenarios are created in partnerships with universities and employers to ensure relevance, rigor, and adherence to best practices.

Since 2017. ASDW is a production and brand management company in the consumer goods, fine collectibles, and entertainment sectors. ASDW engages creators to nurture and realize their ideas into marketable products.

Since 2018. Orion is focused on underserved materials markets with particular expertise in plastics and industrial oils. Capabilities include sourcing, storage, processing, and resale of raw, processed, and recycled materials.

Since 2018. Quant Turtle is a set of proprietary investment systems for professional investors. It offers unique alpha derived from fundamental research, correct application of quant methods within a game-theoretic investment management framework. One of QT’s main strengths is the ability to outperform the market with minimal risk exposure.

Careers

Job openings are announced through our LinkedIn page.

Four to ten weeks internships are available for college and graduate students year-round. The internships are co-managed with career development partners.

Please direct HR inquires by email to info@hpisinc.com.

September 2023 Update: The company operates remotely.

May 2022 Update: Office in Tarrytown, New York opening in July 2022.