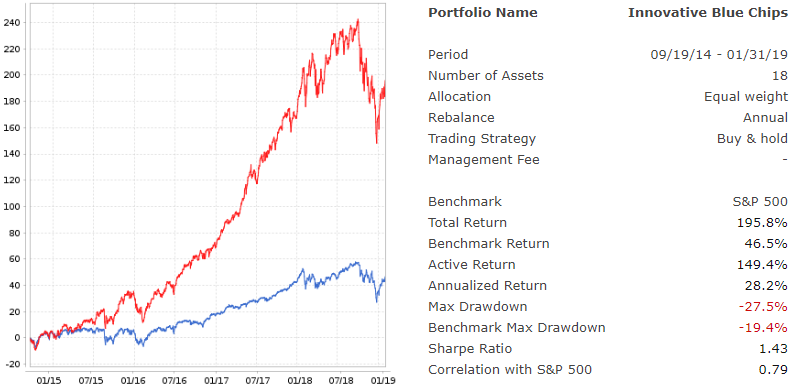

In July 2013 we created a U.S. stock portfolio to test a few ideas:

- buy & hold blue chips that have a track record of developing innovative technologies and products

- focus on Internet technology, fintech, gaming, and defense industries

- ignore short term trends, rebalance annually

- hold fewer than 20 assets

In 2014 BABA was added to the portfolio. The red line shows the performance of this portfolio relative to the S&P 500 (blue line) since BABA was added.

HPIS is developing an algorithm based on these ideas for an active trading strategy. Contact us for more information: info@hpisinc.com

Past performance is not a guarantee of future results.